The 10-Minute Rule for Invoice Factoring

Table of ContentsThe Best Strategy To Use For Invoice FactoringInvoice Factoring - QuestionsLittle Known Facts About Invoice Factoring.The Of Invoice FactoringIndicators on Invoice Factoring You Need To Know

Various from various other forms of invoice money as it doesn't involve a contract for the whole sales journal. You only pick which billings you want to have progressed. This implies you maintain control and have the flexibility to adjust your capital when needed. Most of the times, with discerning billing financing, it's quite usual to receive 100% of the invoice advancement and after that pay a fee. invoice factoring.

The loan provider's threat depends upon your customer or customer as opposed to your very own company. This indicates you can really feel secure in the expertise that billings are being paid as well as you do not have to linger for money for weeks or months at a time. Ahead Finance assists small companies with a cashflow gap.

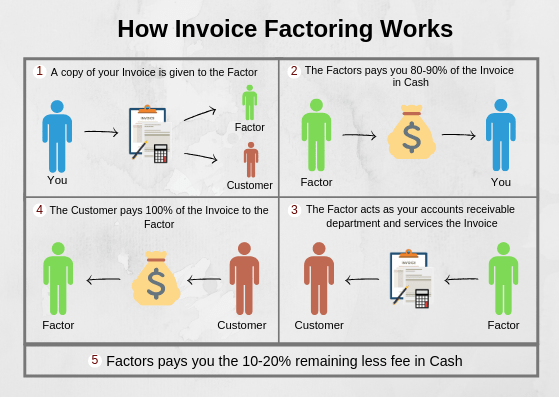

This indicates you can obtain on with the running of your business as opposed to bothering with your capital. It's a straightforward means to raise some funds while waiting on customers to pay you. All you have to do is invoice your consumer as well as send out a copy to your money provider.

Invoice Factoring for Beginners

They'll take their cost and afterwards gather payment on your behalf from your customer. Once payment is gotten, they'll send you any kind of staying balances. Perfect for tiny companies that take care of a whole lot of various customers as well as need their billings to be paid promptly. When SME services wish to money cash money circulation, they in some cases opt for area factoring.

This sort of funding is excellent for businesses with a rather high turnover that are able to market on individual invoices. Great capital in construction is essential. When a company is experiencing numerous stages of an agreement, they require fast and easy accessibility to funds to stop projects from halting.

How Invoice Factoring can Save You Time, Stress, and Money.

An excellent choice for construction services as it implies they can manage seasonal variations and maintain pay experienced workers. See Billing Finance for Building to learn more. A little different from the finance options that we have actually currently covered, export money is a bit a lot more particular. It permits services to release working capital, particularly from abroad transactions.

Nevertheless, usually, the provider will certainly ask for a financial institution warranty or letter of credit report to safeguard the agreement - invoice factoring. Thus minimizing the non-payment threat once the product is shipped or provided. The danger with exports is not obtaining settlement for approximately 90 days after the item has actually been obtained. Your export financing service providers will certainly get the invoice and also bridge the void between these durations.

The Single Strategy To Use For Invoice Factoring

Some only approve organizations that have a turnover of over 250,000 per year and others accept applications from SME's. Have all of your details to hand at the time of using. You can make an educated decision and also select the best monetary provider for you. Unlike a typical lending, billing finance is a reliable type of obtaining money, without seeming like you're obtaining money.

You pay a fee to the lending institution to get every one of that cash. Keeping a healthy money flow when you stay in business isn't simple in all times. So it's excellent to have an alternate path to funding that maintains your company running efficiently. Great deals of financing providers have been experts and trained groups to deal with your clients.

The majority of companies designate a committed account supervisor helpful hints to manage your business. You can likewise have real-time access to your account to see what funds are offered to you as well as take out. Discerning Invoice Financing suppliers can deal with a pay as you go method or agreement. Some service providers provide a test period for a contracted solution.

Not known Facts About Invoice Factoring

Several companies discover it hard to obtain funding such as standard borrowing from the financial institution. You are not judged on your historic economic efficiency but the capability to make sales and also preserve customers. invoice factoring. You're in control of the amount of invoices you submit so you recognize just how much can be eligible for the advancement.